Ascento Capital publishes articles on the best practices and technical aspects of M&A for the benefit of our clients.

Ascento Capital publishes articles on the best practices and technical aspects of M&A for the benefit of our clients.

Sector Research

April 17, 2024 – Funding, M&A and Valuation Data Points to Navigate the Dynamic AI Sector

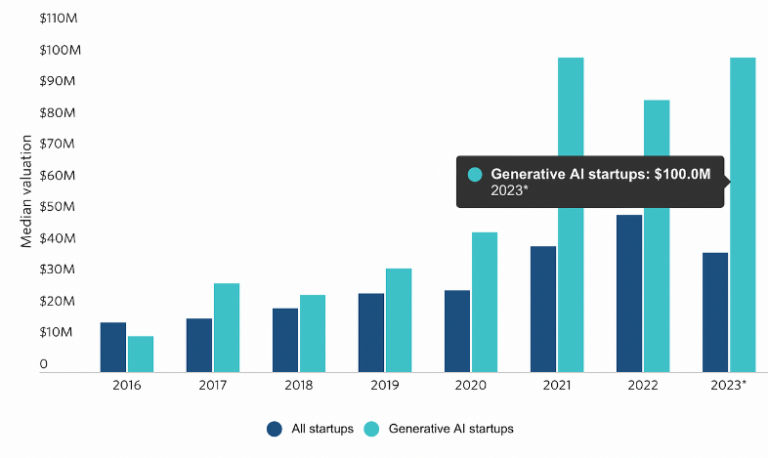

The AI sector is experiencing exponential advances in technology with a new revolutionary developments almost daily. Investment in the tech sector is down significantly, but investment in the AI sector has only decreased slightly by comparison. M&A in the sector is very active with large technology companies the most acquisitive. Valuations are astronomical, which is typical for a large new exciting sector, but coming down to earth slowly. In this dynamic environment, there are practical steps founders and investors can take now to capitalize on the AI sector.

Oct 2, 2023 – Remote Patient Monitoring M&A – 2023 2022 2021 Precedent Transactions

Ascento Capital is an investment bank specializing in the tech sector with extensive experience in HealthTech. This M&A sector report is on Remote Patient Monitoring (RPM) which includes commentary on M&A activity and recent M&A transactions.

May 6, 2022 – Robust M&A Activity in the Data, AI & Analytics Sector

This report analyzes 41 recent M&A transactions in the data, AI & analytics sector. The transactions reveal fascinating trends that are very helpful when considering potential acquirers for an M&A process on the sell side.

Robust M&A activity in the data, analytics & AI sector is driven by the rapid advancement of the technology, particularly AI, ML, predictive analytics, and edge computing, which drives corporate usage and thus increases corporate spend.

January 15, 2021 – Data & Analytics M&A Report

Ascento Capital has extensive experience in the Data & Analytics sector and published a report today on the top Data & Analytics M&A transactions in the latest twelve months with acquirers including Bloomberg, S&P Global, Qlik Technologies, IBM and Microsoft Azure.

September 22, 2020 – 25 Recent Unified Communication M&A Transactions

Ascento Capital has extensive experience in the Unified Communications sector published a report today on 25 recent Unified Communication M&A transactions with acquirers including Microsoft, Zoom, Verizon, OpenText, 8×8 and LogMeIn.

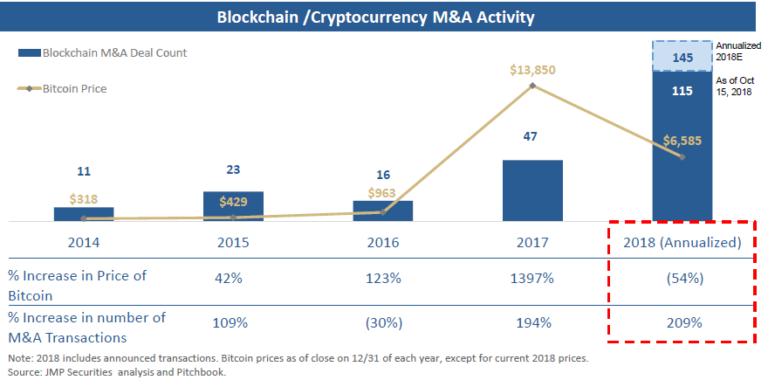

Dec 4, 2018 – 200% Growth in Blockchain Sector Financing and M&A Activity

Total Blockchain and Crypto related deals have surged more than 200% at an annualized rate this year (PitchBook). 115 deals involving cryptocurrency or blockchain had been announced, on pace to hit 145 by the end of 2018. The count is up significantly from the 47 total deals completed last year, when bitcoin’s price was surging to almost $20,000.

M&A Guides

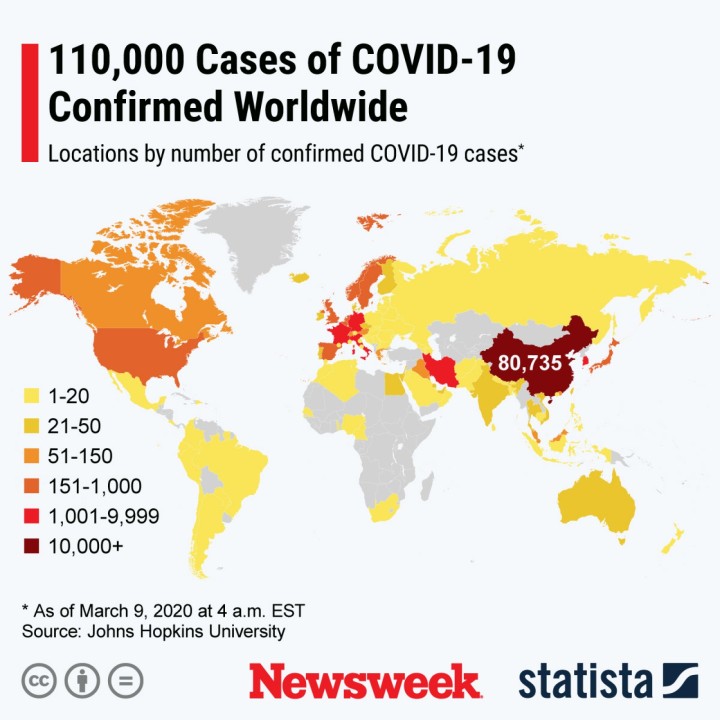

Mar 11, 2020 – Practical Steps Tech Companies can take Now in this Global Crisis

The global environment is suddenly brutal for tech companies with COVID-19 sweeping through country after country, oil falling from $54 a barrel to $30 per barrel and the Dow falling 2,000 points.

But instead of panicking, companies should consider taking practical steps now in operations, financing and M&A in order to generate multiple options for a company to come out ahead.

Apr 30, 2019 – Selling a Company for Maximum Valuation: Critical Steps and Timing

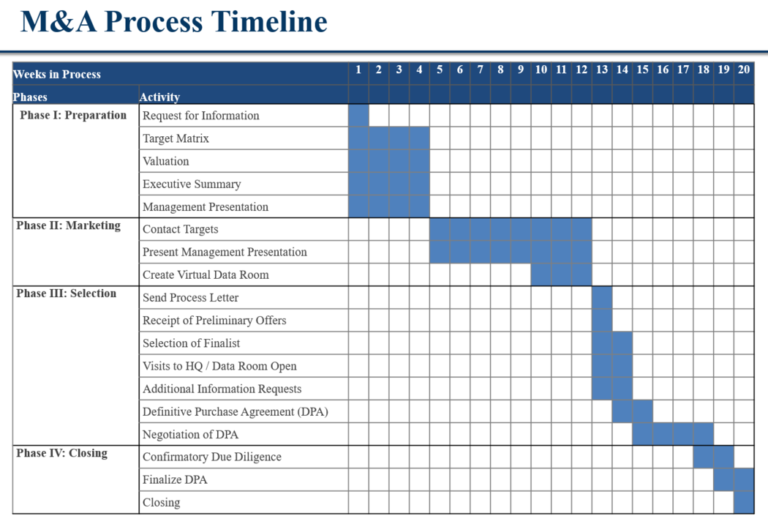

Selling a company is a process not an event. There are many steps on a long, winding road in a process that culminates in a closed transaction.

This article will provide guidance on the steps and timing. The M&A process can be divided into four phases: Preparation, Marketing, Selection and Closing. The process generally takes four to six months, although for reasons explored below, the timing can vary.

Jun 27, 2018 – A Practical Guide to the Intricacies of the M&A Valuation of Tech Companies

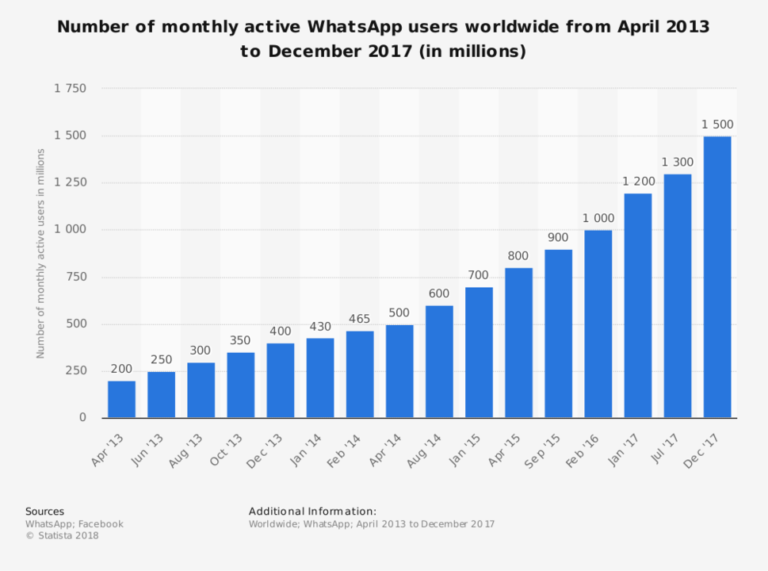

The theoretical metrics of company valuations are well known: compare similar public companies, review precedent M&A transactions and throw in a discounted cash flow (DCF) model for good measure. Then how does this theoretical valuation model account for Facebook’s acquisition of WhatsApp in 2014 for $19 billion when WhatsApp had $20 million in revenue, a 950x revenue multiple? Why is Airbnb worth $31 billion, which is more than Hilton at $27 billion. Why is Uber worth $72 billion, which is more than GM at $58 billion?

May 20, 2018 – Negotiating Working Capital: Maximizing M&A Valuation

The working capital issue can surprise a seller and cost the seller millions of dollars. Many business owners assume the purchase price for their business will be based on a multiple of some financial metric, e.g. revenue or EBITDA. This is generally true, but a buyer typically requires a minimum amount of “working capital” on the balance sheet when they buy the business to ensure there are no immediate liquidity issues. A buyer does not want to pay twice, once to buy the business and then have to inject capital at the closing of an M&A transaction to keep the business running.

Apr 3, 2018 – How to Maximize How Much You Keep When You Sell Your Company

Congratulations you are the majority shareholder and just received several offers to sell your company for $100 million! The question is, at the end of the day, how much will you keep? A lot depends on how well you structure and negotiate the transaction. In the example below, if you sell your company for $100 million, you net $16 million at the closing. But do not despair, this is a worst case scenario.

Mar 17, 2018 – When is the Right Time to Sell a Business to Maximize Valuation?

Timing is the most important factor in maximizing valuation in the M&A process as well. There are multiple cycles at work in M&A in the technology sector: capital flows, competition, technology, and economics. It is critical to follow each cycle carefully to determine when to sell. It is also important to honestly examine your company’s strengths and weaknesses and thus the probability of growing into a billion dollar unicorn.

Feb 10, 2018 – How to Conduct a Successful M&A Sell Side Process

Selling a company is an exciting process. Years of effort building value in a company culminate in a six month process to sell the company. Getting the M&A process right is critical to extract maximum value. “Conduct” is the right word since there are many moving parts in the M&A process. This article will help you ensure that all the parts work together harmoniously for a smooth, efficient and successful M&A process.

Sep 23, 2017 – How to Accelerate Closing a Transaction

Recently I was negotiating a $90 million M&A transaction representing the sell side for an Asian client with unique mobile technology, an excellent management team and blue-chip customers. The valuation was agreed upon by both sides, but many other critical transaction terms remained open.

Dec 7, 2016 – How to Structure Effective Earnouts

An “earnout” is an acquisition payment mechanism where a portion of the purchase price of the selling company will only be paid by the Acquirer if the Seller attains agreed-upon performance goals after the closing.

Well-structured earnouts allow growing companies to increase their sales price and incentivize the Seller’s management team to stay with the Acquirer after the closing of a transaction. By contrast, poorly structured earnouts reduce the Seller’s value to the Acquirer, demotivate management, and result in litigation.

Nov 11, 2016 – How to Maximize the M&A Valuation of Your Company

Many CEO’s and Boards focus almost exclusively on the revenue growth of a company to maximize the M&A valuation. While revenue growth is important in the M&A, it is critical to initiate a robust M&A process and examine the M&A market and its effect on the M&A valuation of your company.

No post found