Ascento Capital – The Biggest M&A Technology Trends in 2021 > Article

Just halfway through Q3 in 2021, Reuters reported the global merger and acquisition (M&A) activity had reached new highs with the aid of low-interest rates and soaring stock prices. The total value of pending and completed deals as of August 2021 was $3.6 trillion, surpassing the full-year total of $3.59 trillion in 2020.

With this record-breaking fever pitch of mergers and acquisitions, companies are leveraging new technology to help with their deal making. Software using artificial intelligence assistance is cutting out the usual work of manually sifting through thousands of contracts.

AI software can now rapidly identify and extract key provisions within thousands of contracts in a fraction of the time it once took. These emerging technologies are enabling a more comprehensive view of due diligence documents.

The future of deal making is combining strategy with cognitive technology. Whether a company is looking to integrate or divest a business, understanding the small details in a corporate contract is essential to avoid hidden surprises in due diligence.

As we enter the halfway point in Q4 2021 of this record-breaking M&A year we’ve seen thousands of deals, many of which are noteworthy. In this article, we’ll take a look at some of the biggest and most significant technology M&A deals of 2021 so far.

Square $29B Afterpay Acquisition

The Jack Dorsey-run payment company Square announced a $29 billion, all-stock deal to acquire Australian-based Afterpay. Dorsey said both company’s share the goal of making the financial system more fair, accessible, and inclusive. The deal is expected to close in the first quarter of 2022.

Salesforce $27.7B Slack Acquisition

Late July 2021 saw one of the biggest technology M&A deals of the year when Salesforce closed its $27.7B Slack acquisition. The motivation for Salesforce was to get its foot into the work-from-anywhere technology area.

Microsoft $19.7B Nuance Acquisition

Tech giant Microsoft announced its second-largest acquisition in company history with the acquisition of Nuance Communications, an established leader in artificial intelligence-aided speech technology. Microsofts’ commitment to the healthcare space was the primary driver behind the deal. Nuance specializes in “conversational AI” for applications in hospitals and doctor’s offices, and 77% of U.S. hospitals are Nuance customers.

Thoma Bravo $12.3B Proofpoint Acquisition

On August 31, 2021, Thoma Bravo, a leading software investment firm acquired Proofpoint, a leading cybersecurity and compliance company for $12.3B in cash. The acquisition news comes in the wake of Proofpoint making a number of acquisitions of its own in recent years including Cloudmark, Weblife, OberservelIT, and Meta Networks – all deals valued in the hundreds of millions of dollars.

Hitachi $9.6B GlobalLogic Acquisition

Hitachi, the Japanese industrial giant announced its plans to acquire GlobalLogic Inc., a privately held digital engineering services company based in Silicon Valley. Hitachi made the acquisition to strengthen the digital portfolio of Lumada, its digital solution business. Lumada is focused on “social infrastructure” projects in areas such as rail, energy, and healthcare.

Extensive Deal Experience

Deep Expertise and Senior Level Relationships

in the Technology Sector

Okta $6.5B AuthO Acquisition

After eight years of courtship Okta finally closed its $6.5 deal with AuthO in Q1 2021. Okta software helps people sign into digital accounts while AuthO pitched its services to coders who wanted to create sign-in options for their own applications. Negotiations took six months and ended with an early March agreement of Okta buying AuthO for about $6.5B in stock.

Visa $5.3B Plaid Technologies Acquisition

This was set to be one of the biggest acquisitions of the year but it never happened. Visa and Plaid Technologies terminated their merger agreement in the wake of a U.S. government antitrust lawsuit. The U.S. Justice Department said in its lawsuit that Visa was “a monopolist in online debit transactions” and that the merger would “eliminate a nascent competitive threat” to the monopoly.

AVEVA $5B OSlsoft Acquisition

Aveva, a leader in industrial performance applications, completed its acquisition with a deal value of $5B of operational data platform developer OSlsoft. It’s a move to give AVEVA the capabilities to help industrial customers accelerate their digital transformation efforts. AVEVA markets a range of industrial applications including plant operations and process manufacturing software and asset performance management applications. OSlsoft, develops a PI System real-time industrial data platform that records data from process control systems.

Cisco $4.5B Acacia Communications Acquisition

After some legal obstacles, Cisco closed its $4.5B deal for optical maker Acacia Communication, Inc. in March 2021. Cisco was after Acacia’s high-speed, optical interconnected technologies that let data center operators, webscale companies, and service providers offer faster services. It also meshed with Cisco’s commitment to optics as a building block.

Qualcomm $4.5B Veoneer Acquisition

In early Q4 chipmaker Qualcomm Inc. reached an agreement to buy Swedish automotive technology group Veoneer for $4.5 billion. Veneers’ expertise in making advanced driver assistance systems (ADAS) caught the eye of Qualcomm. The two companies got to know each other after signing a collaboration deal to develop a software and chip platform for driver-assistance systems called Arriver in January 2021.

Follow Ben on Twitter!

Ben speaks regularly on panels on the technology sector and corporate

finance and has appeared on TV at Fox Business News and Bloomberg.

STG $4B McAfee Enterprise Business Acquisition

In March McAfee Corp., a device-to-cloud cybersecurity company agreed to sell its Enterprise business to Symphony Technology Group (STG) in a cash transaction for $4 Billion. McAfee has established its reputation as a leader in cybersecurity for more than 30 years. The business is a trusted partner for 86% of Fortune 100 firms around the world.

Dell sells Boomi to Private Investors for $4B

Another big shake up in the tech sector happened when Dell Technologies Inc. announced that private equity firms Francisco Partners and TPG Capital will acquire Dell’s Boomi integration platform as a service, or iPaaS, business in a $4 billion deal. Boomi is software that reduces the amount of time required to build data integrations from months to weeks. Outside of integrations, the software can also be used for tasks like sharing information with a company’s suppliers and building data catalogs.

Citrix $2.25B Wrike Acquisition

In early Q1 Citrix acquired Wrike, a SaaS project management platform, from Vista Equity Partners for $2.25 billion. Vista had purchased the company itself in 2019. Citrix is best known for its digital workspaces, saw Wrike as a powerful addition to help deliver solutions needed to power a cloud-delivered digital workspace experience.

Vista $1.5B Blue Prism Acquisition

The robotic process automation (RPA) market got attention when market pioneer Blue Prism was purchased by Vista Equity Partners in England. Many RPA startups were acquired by larger vendors in 2020, but this was the first transaction that involved one of the top three vendors in the space. The transaction is complex, as Vista has set up an entity called Bali Bidco Limited which is indirectly owned by Vista Funds and will be purchased on behalf of Vista, according to the filing. It’s not clear why they used that financial mechanism.

Adobe $1.28B Frame.io Acquisition

In early Q3 Adobe announced its acquisition of Frame.io, a video review and collaboration platform used by over a million customers. The New York-based company was created to solve workflow challenges for filmmakers. Today Frame.io helps creative professionals streamline their video creation process by centralizing media assets. Another standout for the company is its faster upload speeds when compared to other cloud hosting services, like Vimeo, Box, and Dropbox.

Mergers & Acquisitions with Ascento Capital

We have developed a rigorous process that creates the most competition and optimizes the result.

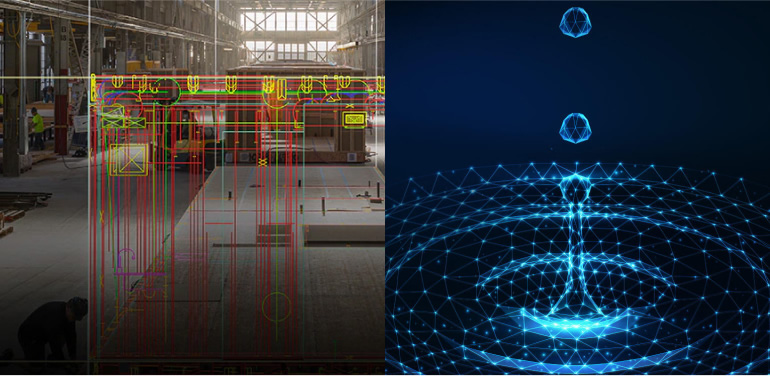

Autodesk $1B Innovyze Acquisition

In early Q1 Autodesk announced the largest acquisition in the company’s history. The motivation behind the Innovyze purchase was to position Autodesk as a provider of end-to-end software for water infrastructure operators. Innovyze’s technology is used by organizations such as water and sewer utilities, river and flood authorities, and manufacturing plants to design things like water distribution networks, collection systems, and flood protection systems.

Visa $700M Currencycloud Acquisition

Visa announced an agreement to acquire Currencycloud, a cross border payments platform. The deal builds on an existing strategic partnership between the two companies. Currencycloud is a cloud-based platform that offers a broad set of APIs enabling banks and financial services providers to offer currency exchange services. It includes features like real-time notifications on foreign exchange transactions, multi-currency wallets, and virtual account management.

Square $297M Tidal Acquisition

In late Q1 Jack Dorsey’s Square agreed to acquire a majority stake in Jay-Z’s music streaming service Tidal for $297 million. Tidal was purchased six years ago by Jay-Z to give artists more control over the distribution of their music. Today, Tidal offers 70 million songs and 25,000 videos to listeners in 56 countries.

LG $240M Cybellum Acquisition

In late Q3, Korean tech giant LG announced its acquisition of Cybellum, an Israeli automotive cybersecurity specialist. Cybellum detects and assesses vulnerabilities in connected vehicle services and hardware using a “digital twin” approach. LG continues to build a profile as an investor in innovative automotive startups. This acquisition signals LG’s interest is not just in hardware but in providing software solutions to the auto industry.

Xero $183M Planday Acquisition

In late Q1 Xero Limited announced the acquisition of Planday, a workforce management platform that simplifies employee scheduling by allowing businesses to forecast and better manage labour costs. Today the platform has more than 350,000 employee users across Europe and the UK. By acquiring Planday Xero will help more small businesses save time and money.

Extensive Focus,

Connections, and Experience

Dropbox $165M DocSend Acquisition

Dropbox acquired DocSend giving its popular platform an end-to-end secure document-sharing workflow. The San Francisco based DocSend helps businesses bypass cumbersome email attachments through its link-based document sharing capabilities. The platform allows companies to control file downloads and deactivate access at any time while getting real-time engagement insights. DocSend also allows companies to ensure the version of a file they have shared remains up to date.

F5 $68M Threat Stack Acquisition

In late Q3 F5 Networks announced its plan to acquire Boston-based cloud monitoring company Threat Stack for $68 million. This acquisition is the latest of many for the Seattle based application security and delivery company, that’s recently spent more than $2 billion in buying up a variety of cloud and security software ventures over the past three years.

Point Pickup $42M GrocerKey Acquisition

Last-mile delivery service Point Pickup Technologies acquired white-label e-commerce platform GrocerKey for $42million. Point Pickup now allows retailers to offer same-day delivery under their own brand name rather than relying on a third party like Instacart. The same-day delivery industry is expected to hit $20.36 by 2027.

VMware Acquires Mesh7 for Undisclosed Amount

VMware acquired cloud-based application security startup Mesh7 in an effort to boost the company’s Kubernetes, micro-services, and cloud-native capabilities. It was VMware’s first acquisition in 2021. VMware says the Mesh & tech will enable the company to bring visibility, discovery, and better security to APIs.

Apple Acquires Primephonic for Undisclosed Amount

In mid Q3 Apple announced its acquisition of Primephonic to expand its classical music offering. The Amsterdam-based service launched in 2014, and brought a laser-like focus to classical music. The service discontinued its standalone offering in September as it was absorbed into the Apple Music platform.

For more information, please contact Ascento Capital

646-286-4589 | info@ascentocapital.com

745 Fifth Avenue, Suite 500, New York, NY 10151

Zendesk Acquires Cleverly for Undisclosed Amount

In mid Q3 Zendesk announced its purchase of early-stage artificial intelligence startup Cleverly. The financial terms of the deal are not being publicly disclosed at this time. Cleverly has not been transparent about the size of its funding. Cleverly’s product platform provides a series of artificial intelligence powered capabilities like a triage function to automatically tag incoming service requests to help categorize workflows.

IBM Acquires Turbonomic for Undisclosed Amount

IBM announced its acquisition of Turbonomic, a provider of software that helps companies monitor the performance of their business applications. This is the acquisition in a series of cloud computing acquisitions by IBM. The transaction values Trubonomic at between $1.5 to $2 billion, individuals familiar with the deal said on condition of anonymity. If true, it would be IBM’s largest acquisition since it acquired Red Hat in 2019 for $34 billion.

Conclusion

The deal activity for both established tech companies and startups over the past year doesn’t seem to be slowing down. Many companies are looking at the market conditions and their business objectives and moving forward with mergers and acquisitions they had been delaying for years in some cases. Many of these additions are non core businesses value adds. The increased regulatory scrutiny hasn’t dissuaded tech CEOs from taking a growing interest in new opportunities.

More competition in tech keeps pushing companies to find new ways to provide services to keep sales and growth steady. Nobody is expecting a slowdown in technology mergers and acquisitions (M&A) as we head into 2022.

Extensive Deal Experience

Deep Expertise and Senior Level Relationships in the Technology Sector